Wishy-washy launderers, Vee for victory, and Bud at the Bowl (Issue #9)

Plenty of dazzle, but none of it from Razzle.

From unlikely crypto bandits, to one very likely NFT hero, a record-breaking CryptoPunk sale, and animated cats getting pets of their own, it’s been another stranger-than-fiction week in NFT land.

And things are only going to get stranger. The Super Bowl this Sunday is destined to be awash with crypto and NFT content and there’s no telling what effect that’s going to have on trade volumes or project floors, but we’re expecting action one way or another.

Right, let’s get straight into it!

DYOR 🧐

There’s a frequently bandied about maxim among frequent tweeters that states, “Each day on Twitter there is one main character. The goal is to never be it.”

Usually, being Twitter’s main character means you’ve done or said something deplorable, idiotic, racist, or all of the above… but once in a while the main character is a hero, not a villain. This week, NFT Twitter had a main character, and it was Gary Vaynerchuk, who turned antagonistic questions about the NFT sector from CNBC anchor Hadley Gamble into a mic drop moment that’ll be meme’d for years to come.

Vaynerchuck’s key points? Cryptocurrency and NFTs are “a new avenue of innovation” which, like every other that’s come before (and like society at large), “has good characters and bad characters.” To paint every participant with the same brush just because there are some bad actors is as reductive and disingenuous in the NFT space as it is in any other.

On the issue of NFT’s “value,” Vaynerchuck points to the numerous now-famous artists who were once ignored, the fact that sports cards and sneakers weren’t considered assets until relatively recently, and that historically, mainstream opinion alone doesn’t dictate what’s valuable, no matter how much the opinionated wish it did.

“The market will decide if something has value,” Vaynerchuck said. “We are living more and more, increasingly, in a digital landscape, and NFTs become assets to communicate who you are, and that’s something human beings have done forever: bought things to communicate. And NFTs will be the scaled version of that.”

Amen.

🦊 School fees ⚓️

Probably nothing 🤔

Peep those glasses, bud 🤓

A few weeks ago we mentioned beermaker Budweiser had bought a Noun for its “Bud Light” sub-brand. We still don’t know what it’s got planned for it, but we do know we’re going to see the trademark (but not trademarked, because Nouns are copyright-free) glasses during a Super Bowl ad. The ad you can see below, in fact:

Nouns already command upwards of 80 ETH each on average. Will a fleeting appearance at Sunday’s game boost that even further? We’ll wait and watch, but it’s definitely a bullish sign no matter how you look at it. With Coinbase, FTX, and Crypto.com all expected to have Super Bowl ads of their own, next week could be a wild one for both crypto and NFTs.

YouTube’s got metaverse plans 📺

A few years ago, it seemed like YouTube was online video’s final form. Short video service Vine had been killed off in its prime, Vimeo remained a platform for showreels and artists, and only streaming services offered meaningful competition for eyeball time. But as it grew YouTube’s moderation woes worsened, it came under scrutiny from regulators, and TikTok showed up and changed everything.

In a blog post this week looking ahead to its 2022 plans, YouTube’s chief product officer Neal Mohan says the service is considering an NFT play. Just what that’s going to look like, though, remains pretty vague.

We believe new technologies like blockchain and NFTs can allow creators to build deeper relationships with their fans. Together, they’ll be able to collaborate on new projects and make money in ways not previously possible. For example, giving a verifiable way for fans to own unique videos, photos, art, and even experiences from their favorite creators could be a compelling prospect for creators and their audiences.

Meet the BAYC founders 🐒

This week, a BuzzFeed article revealed the identities of two of the four people behind Bored Ape Yacht Club, the PFP project that continues to top the charts for sales volumes more weeks than not. Some called it a doxxing and decried it, others pointed out that the information — which was gleaned from publicly available records like Yuga Labs incorporation documents — was there for anyone who cared to look. It’s just that no one else had cared to.

What followed was the remaining two, delightfully normal-looking, hitherto anonymous founders, revealing their own identities, and important discourse about whether or not anonymity is a virtue of web3, a liability to its success, something that shouldn’t be granted to those running billion-dollar businesses, or some combination of the above.

In the case of BAYC, though, the move doesn’t appear to have done it any harm. If anything, it’s positioned it for its next growth phase. Like it or not, knowing who’s behind a project remains important for many investors, particularly those from web2 backgrounds. When your project has the same market cap as some Fortune 500 companies, you can’t really blame people for wanting to know who’s running the show.

🔐 Security issues 🗝

NGMI 🚽

To pilfer is human, to launder divine 🧺

Unless you’ve just returned from a weeklong silent retreat beyond the reach of cellphone signal and this is the first thing you’re reading, you’re probably aware of this week’s high-profile arrest of two very unlikely seeming hackers, thirtysomething husband-and-wife duo, Ilya "Dutch" Lichtenstein and Heather “Razzlekhan” Morgan.

Accused of stealing over 119,754 BTC (~$5,1 billion today) from Bitfinex in August 2016 in a hack so severe it caused Bitcoin to dip 20% for a time, the couple found laundering their loot significantly more challenging than acquiring it. More challenging, even, than keeping it secret. For a great explanation of the complexities of laundering on the blockchain, check out Bloomberg columnist Matt Levine’s excellent and detailed (but paywalled) piece titled “Business Rapper Was Bad at Bitcoin Laundering.”

On the positive side, the news of the duo’s arrest sent Bitfinex’s coin soaring. On the negative, the U.S. government now holds $3.6 billion in bitcoin, bringing its stack to $4 billion, or double Tesla’s… and Razzlekhan’s “raps” have now been inflicted on way more people than they ever deserved to reach.

Squiggles and squirmers 〰

First came the hype, then came the accusations of a rug pull, and finally OpenSea delisted the project. We’re talking, of course, about Squiggles. Various Twitter users’ sleuthing turned up all sorts of questionable transactions, wallet interactions, and a possible history of malfeasance from key members of the team.

While the team hasn’t admitted any wrongdoing, OpenSea isn’t taking any chances, and the U.S. Securities and Exchange Commission (SEC) has received a nearly 60-page document detailing the alleged scam.

Another hot mess 🌋

Larva Labs, the company behind CryptoPunks, got NFT marketplace OpenSea to take down the V1 Punks Collection it was hosting by claiming copyright infringement.

This is just the latest in a growing list of moves by Larva Labs to protect its IP, something it’s admittedly entitled to do, but something which isn’t winning it any fans. It’s not merely that the NFT space (by and large) favors openness, and that there’s a growing movement towards letting buyers do what they want with their NFTs, but it makes LL look litigious, petty, and mean.

To the moon 🌜

One of the most talked-about events of the week was the Karafuru reveal. Sales now exceed 27,000 ETH (~$78 million) and the floor price is hovering around 4.9 ETH (~$14,000). With 5,500 items and over 3,600 owners, it has all the hallmarks of a project which has plenty of action left in it yet.

Heidi Klum bought a CryptoPunk. That’s right. Not an Ape, but a Punk. Could this lead to a fresh run on the OG of OG PFPs?

Well, possibly. Despite anger at Larva Labs protectionist stance over its IP, Punks are still achieving record-breaking sales numbers:

Meanwhile, Punk6529 (one of the most recognizable, but anonymous, CryptoPunk holders) has launched a fund to allow institutional investors to invest in NFTs… but still hasn’t had to reveal their identity, which seems like a possible first for a fund manager who could be in control of tens (or hundreds) of millions of dollars.

Speaking of hundreds of millions of dollars, Binance is making a $200 million investment in Forbes. Forbes reportedly has plans to go public via a special purpose acquisition company (SPAC) later this year, and the move will make Binance one of the two biggest owners of the legacy media company, plus it’s getting two of nine board seats. The takeaway? Content is going to be key to web3.

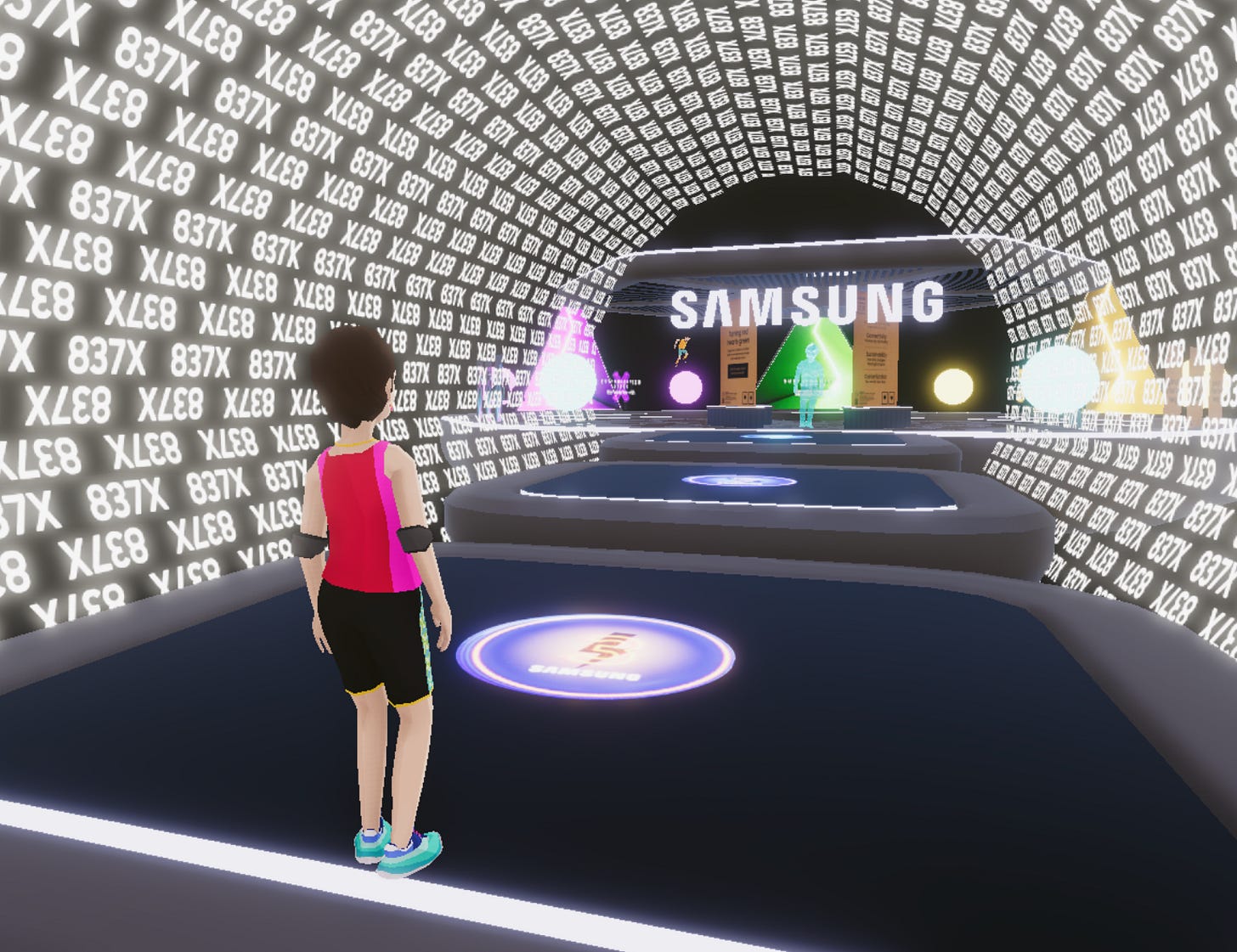

Samsung hosted a launch event for its new Galaxy S22 devices in Decentraland. It wasn’t seamless, but it was bold, and something that’s sure to be replicated by other consumer tech companies soon enough.

AssangeDAO, a DAO set up to try and get Wikileaks founder Julian Assange released from jail, raised 12,569 ETH (almost $40 million) on JuiceBox, the same platform used by ConstitutionDAO late last year, and a larger raise than it managed when measured in ETH.

Oh, and lest we forget, Cool Cats “Cool Pets” drop sold out in two minutes. If you think PFP projects are over… think again.

🧵 Thread of the week 🪡

Goats only 🐐

When ETH goes down, NFT sales tend to go up. Whether you can explain that correlation in excruciating detail, or have no idea why it’s the case, you should be watching or listening to Goats and the Metaverse.

In each episode, collectibles OG and entrepreneur Stan “The Goat” Meytin and Metaversal co-founder and CEO Yossi Hasson talk about digital and IRL collectibles, historical and freshly minted NFTs, and the news worth knowing.

This week the team’s been extra busy. They’ve considered the implications of the BAYC founders identities being revealed, discussed the $7.7 million CryptoPunk sale, offered some tips on how to avoid getting scammed when buying NFTs, and in the latest episode below, explained how Cool Pets are earning Cool Cats owners a cool $8,000:

Aside from providing invaluable insights into digital art and collectibles, Stan and Yossi have also put together a collection of NFTs dubbed “The Goat Vault.” When the show hits 5,000 subscribers on YouTube, one of those lucky subscribers will win the contents of the vault which, at last count, was valued at over $88,000.

Prefer listening? Check out Goats and the Metaverse on Apple Podcasts, Spotify, Anchor, or wherever you get your podcasts.

📸 Show us your PFPs 📈

LFG 🎉

See you in Denver 🏔

We’re going to be at ETHDenver next week, so if you see people wearing T-shirts with beautiful MetaLetters on them, you know why… and you can ask them where to find us.

Failing that, you can head to the 6th floor of the Web3 Castle MakerSpace. We’d love to connect IRL, so if you’re going to be in Denver too, come on by and say hi. You can also find out more about what we’re up to in nearly real-time by joining the Metaversal Discord. Come on in, the water is fine!

Money <> mouth 💸

Each week we’ll offer you a look at an NFT project or collection we’ve invested in and the motivation behind it. This week we’re talking Cryptoys, a project that’s dear to our hearts, and which is only just beginning to show its long-term potential and value.

Cryptoys Classics (like the no. 1142 pictured above) are 2D pixelated characters created as gifts for early supporters of the Cryptoys project. Cryptoys are a mix of toys (duh), collectibles, and gaming… all wrapped up in adorable NFTs. Owners will eventually be able to interact with them, and they’ll be useable in a variety of games and applications in the accompanying “Cryptoyverse.” Suffice to say, we think they’re going to be a thing.

IYKYK 😉

🇹🇷 Turkish Martha Stewart 💀

Yes, we know we’ve already spoken about this miscreant, but this is too good/bad not to share. If either Turkish Martha Stewart or Razzlekhan show up in your nightmares we apologize in advance.

Until next time, see you in the Metaverse.