Skullduggery and the WoW factor (Issue #5)

If you're planning to play you're going to want oven mitts.

The major cryptocurrencies may be down, but the NFT market continues its incendiary run. But where there are winners, there inevitably have to be losers, so it’s no surprise the successes haven’t been uniformly distributed. The projects that have benefited from this flurry of activity include an OG previously left for dead, and another that shows the value that patience, a clear plan, and a committed crew can bring to a project.

Right, let’s get straight into it!

DYOR

CryptoSkulls is a project of 10,000 PFPs that launched in 2019 but hasn’t enjoyed the same sort of infamy — or trade volumes — as CryptoPunks, from which it clearly took inspiration. That changed this week.

In a matter of days, the floor for CryptoSkulls has rocketed to 0.9 ETH, and Twitter has lit up with OG-maximalists extolling the virtues of the project and showing off their original acquisitions… or their fresher ones.

OG projects have one thing no contemporary project can replicate: historical relevance. But as we’ve seen with CryptoPunks, that doesn’t make them invincible. Increasingly, buyers expect to be able to do with their IP whatever they want to, they want a vibrant community around a project, and they want to see ongoing efforts to build on it, whether that’s via merch, airdrops, events, or something else.

CryptoSkulls ticks all of those boxes. And both established and newcomer NFT collectors are noticing.

Granting owners IP rights has also proved instrumental in two of this week’s other big success stories: Doodles (more on it below) and World of Women. This week, World of Women announced Guy Oseary, the legendary manager and promoter of Madonna, Red Hot Chili Peppers, U2, and — closer to home — Bored Ape Yacht Club, is taking it on as a client, and that it’s granted full IP rights to WoW holders.

The market absolutely loved the news. WoW’s floor price doubled overnight, and it’s now sitting at more than 8.3 ETH (~$27,400), which has also propelled the project into the top 10 projects by volume over the last 30 days.

What’s the lesson here? Openness matters. And it’s only going to become more important, especially where PFP projects are concerned.

🥄 Well, are you? 🤔

Probably nothing

StockX is getting into NFTs 👟

Streetwear, sneaker, and gaming console reseller StockX is looking for a “Senior Product Manager, NFT” to, well… it’s not totally clear what the successful candidate will be doing, really. The job description includes phrases like “drive requirements,” and “coalesce strategies,” which isn’t very illuminating. But with the likes of StockX staples Adidas and Nike now playing in the NFT space, reseller companies like it getting in on the action was pretty much inevitable.

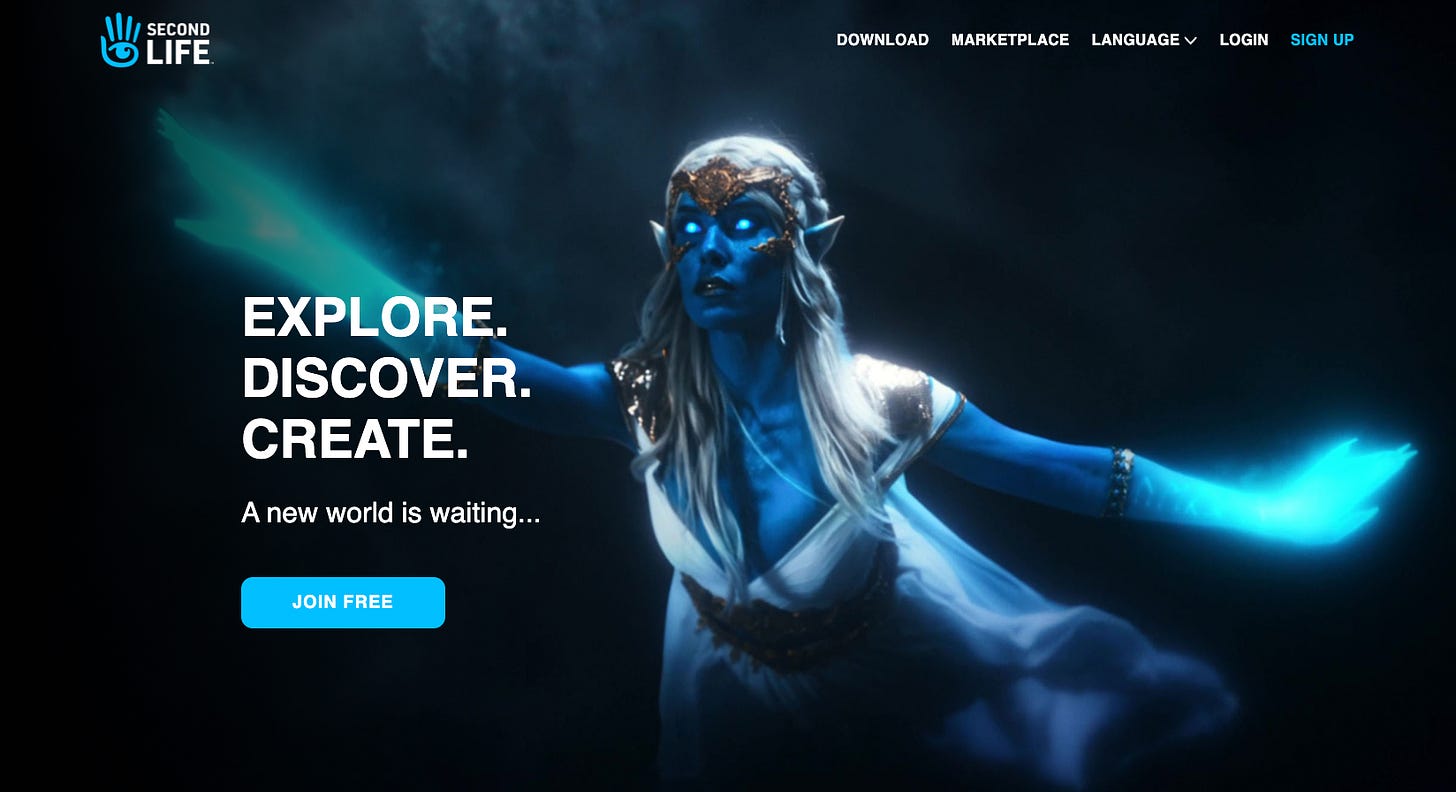

Second Life’s second chance ✌️

The founder of Second Life, the original metaverse playground that never quite made it to mainstream adoption, is coming back to the company after leaving it more than a decade ago. Philip Rosedale launched Second Life in 2003, and by 2010 it had hundreds of thousands of regular users and an in-game currency (Linden Dollars) that could be cashed out for fiat. Despite regular updates and new features, though, Second Life never enjoyed the sort of uptake needed to turn it into a Roblox or Fortnite-scale game.

Rosedale is returning, in part, because he’s concerned that companies like Meta’s Facebook — which tracks users and uses data on them for serving targeted ads — present an “existential risk” to the Metaverse. We’re inclined to agree with him. Here’s hoping the company’s experience and ethos can be translated into a compelling product. It may not have Facebook’s userbase… but at least its avatars have legs. Which is a good start.

Getting DAO’d and dirty 🗑

Dirt is an online newsletter ostensibly about entertainment, but really it’s more about entertainment culture and how it intersects with online-ness. Last year it sold a few NFTs, less as tradeable collectibles than as a means of getting financial support from loyal readers and giving them something novel in return.

But now the newsletter is launching a DAO, creating a token, and letting NFT/token holders vote on which pitches from freelancers it chooses to commission and publish… which makes it an intriguing early example of how the future of media could shape up (or shake down).

Machines trading monkeys 🤖

GSR, the cryptocurrency market maker, is getting into algorithm-powered NFT trading, The Block reports. GSR currently trades over $4 billion in crypto each day, and co-founder Richard Rosenblum (formerly MD at Goldman Sachs) says GSR is working on applying the same techniques it uses for crypto trading to the NFT market.

👋 Get off my timelawn 🤷♀️

NGMI

⚖️ Tokenized litigation 🎰

It’s no secret Americans are litigious. They’re also known to enjoy betting on things (sports, the stock market, crypto). So, what if you combined these things into a single activity? That’s the question Ryval is seeking to answer, even if no one else is asking it.

Look, betting on the outcome of court cases or bankrolling them is nothing new, it’s just something that’s traditionally been the purview of high-net-worth individuals or institutional investors. And it hasn’t generally come with the ambitious (and perhaps disingenuous and SEC-baiting) promise of “50%+ annual returns.” Should more people be able to afford to litigate? Sure. But should we gamify and tokenize the justice system to make that happen? Perhaps not.

👑 Another Royal scandal 🎵

This week Royal.io was meant to launch NFTs in conjunction with OG hip hop star Nas that would grant holders a share of the streaming revenue from a pair of tracks being NFT-erized. Instead, would-be music moguls were faced with a broken website and a notification that the drop was being pushed out by a week to deal with the technical challenges.

We’re willing to forgive Royal the misstep, after all, this was its first release, and Nas is an icon — demand was always going to be intense. Plus, we’d rather a drop was done right than see it paused midway, ruined by bots, or face any of the other problems oversubscribed ones have been known to. We’re saddened, however, by the realization that next week, demand is now likely to be even fiercer.

To the moon

Double-digit Doodles 🧮

On January 8, Doodles floor price hit 10 ETH, and it’s continued to creep up subsequently. The reason, according to The Defiant, can be attributed to the combination of community input and astute management. Having a big name like Pranksy collecting enthusiastically and dropping nearly 300 ETH on a single Doodle definitely helps.

Doodles also has a DAO, and a new project coming next month that’ll let existing holders mint a “Space Doodle.” So we wouldn’t be surprised to see that floor move significantly higher before the month is out.

Here’s looking at you, kid 📸

Indonesian twenty-something, Ghozali Ghozalu, sold 933 selfies on OpenSea for 0.001 ETH ($3.25) apiece. The collection — Ghozali Everyday — is sold out, and doing a roaring secondary trade. The floor is sitting at 0.02 ETH, there are 466 owners (or, at least, 466 distinct wallets with a Ghozali selfie in them) and the collection has seen over 320 ETH (~$1,051,000) in sales volume.

The project is one of the most wholesome we’ve ever seen. On Wednesday, Ghozalu tweeted, “You can do anything like flipping or whatever but please don't abuse my photos or my parents will very disappointed to me.”

What’s he doing with his newfound fame and fortune? First up, he’s trying to work out how to pay the necessary taxes on his windfall. Like we said, wholesome.

Miscellaneous missives from the Metaverse 📰

MoonPay, the cryptocurrency marketplace and concierge NFT service to the stars, bought a $3 million CryptoPunk. The Associated Press is launching its own NFT marketplace on Polygon to sell iconic news photographs. And a new DAO called LinksDAO wants to buy and manage a golf course.

Meanwhile, Cognac maker Hennessey is launching NFTs via the booze-orientated BlockBar platform. And Pudgy Penguins’ creators may have a coup on their hands following acquisition plans that have provoked and pissed off the penguin posse.

Goats only

Whether you’ve been banging the NFT drum since Punks were free or you’ve just been convinced to buy your first crypto because of an ad you saw on the subway (seriously, those are now a thing), you should be watching or listening to Goats and the Metaverse.

Each week, collectibles OG and entrepreneur Stan “The Goat” Meytin and Metaversal co-founder and CEO Yossi Hasson sit down with a guest to talk about digital and IRL collectibles, NFTs, and the week’s news worth knowing. Stan and Yossi are back from vacation and this week they’re talking about the red-hot NFT market that’s dominated the early weeks of 2022. Check out the episode here:

Aside from providing invaluable insights into digital art and collectibles, Stan and Yossi are also putting together a collection of NFTs dubbed “The Goat Vault.” When the show hits 5,000 subscribers on YouTube, one of those lucky subscribers will win the contents of the vault which, at last count, was valued at over $75,788.

Prefer listening? Check out Goats and the Metaverse on Apple Podcasts, Spotify, Anchor, or wherever you get your podcasts.

LFG

Meet the first MetaLetters 🔠

Last week we issued our first artist call and announced the MetaLetters DAO, the mission of which is to foster the next generation of culture, and we’ve already received some awesome submissions.

MetaLetters is an artist activation project with a goal to invest in and support creators across the globe. We’re dropping one letter every day (M-E-T-A-V-E-R-S-A-L) until we reach 1,818 letters. Each letter is a one of one, and we’ll soon begin auctioning one letter each day.

Whether you’re an established artist or just getting started, we’d love to see what you create. So head to our Twitter or our website to find out how you can participate, and how you can be involved in helping to support the artists and creators of tomorrow.

Money <> mouth 💸

Each week we’ll offer you a look at an NFT project we’ve invested in and the motivation behind it. This week, it’s CryptoKitties in the spotlight, and 7 gem kitty, in particular.

CryptoKitties was one of the first Ethereum-based games, which we believe gives it significant culture cache and historical value. Moreover, this is one of the 100 founding CryptoKitties, and it’s never been bred… despite the appeal of seeing how its fetching jaguar-patterned coat and beard might manifest in future generations. It’s also got a killer bio:

Heyo! I'm 7 gem kitty. In high school, I was voted most likely to work at NASA. My friends describe me as "tantalizing." It's... accurate. I look forward to licking doorknobs with you.

Watchlist 👀

If you’re only buying digital art using Ethereum, we’d argue you’re missing out. A growing number of outstanding projects are choosing to launch on platforms that use Solana or Tezos, at least in part because of their comparatively tiny transaction fees. One such platform we’re watching is Holaplex, which is less a platform on its own and more a platform for platforms.

Holaplex is an easy-to-use Solana NFT storefront builder for artists. We like it so much we’ve invested in it. If you’d like to know more about how it came to be, why it believes empowering artists to take control of how their work is distributed matters, and what the future of e-commerce might look like, be sure to read our interview with founder Alex Kehaya.

IYKYK

Next time someone asks you “what’s the point” of NFTs send them this tweet:

The best (and worst part) of it is, it’s not even exhaustive. For a start, as Twitter user @gypsielou points out, the diagram doesn’t even include artist royalties, which for many is one of the most potent tools in the NFT toolbox. But it’s still an impressive snapshot of where things stand… and provides some hints as to which parts of this nascent economy are ripe for new entrants.

Until next time, see you in the Metaverse.