Rare looks, hexagons, and customizable UFOs (Issue #6)

A tale of squeaky-clean Meebits, six-sided flexes, and an out-of-this-world drop.

Phew. What a wild week it’s been. We saw a big tech behemoth, Microsoft, try to acquire a gaming giant, Activision Blizzard, so it can stake a claim as a Metaverse builder. That’s the sort of acquisition-and-consolidation play we’re used to from tech giants.

At the same time, we saw a new marketplace, LooksRare, use publicly accessible data to create an instant userbase and, with it, an immediate threat to a pretty firmly entrenched incumbent, OpenSea. That’s the sort of fracturing and decentralization we’ve come to expect from Web3.

Meanwhile, Meta’s Facebook and Instagram plan to allow users to mint and display NFTs using its platforms, Twitter added the ability to use NFTs as PFPs, Google announced plans to launch an AR headset, Adidas has a new NFT-focused collab with Prada, and Crypto.com did get hacked after all but shored up all affected account holders. Like we said: a wild week.

Right, let’s get straight into it!

DYOR 📊

NFT marketplace and OpenSea rival, LooksRare, only launched on January 10, but it’s already causing waves. First, it’s rewarding those who use it to trade NFTs with its own LOOKS token. Second, it gave $400 million worth of LOOKS tokens to all OpenSea users who’d spent over 3 ETH on NFTs in the second half of last year. Those tokens have since more than doubled in value, and holders also have the option to stake them for what, for now at least (the returns will dramatically drop in time), are impressive returns of over 700% APR. Oh, and LooksRare has done over $1.5 billion in volume in 10 days.

Of course, that volume number is, well, a little fuzzy to say the least. LooksRare rewards users for the percentage of the platform’s total daily volume their trades represent… which incentivizes wash trading (the same user, or group of users, buying and selling between themselves to artificially inflate trade volume). The platforms most prolifically traded NFTs have been Meebits. Why? Because they don’t include any royalties, which makes them perfect for wash trades.

Some people think staking LOOKS is nonetheless a great investment opportunity. Others think it’s a “house of cards” that’s “completely detached from the fundamentals.”

Nonetheless, even without the fudged numbers, LooksRare’s strategy has obviously paid off to some extent. It used publicly available data to identify and entice users worth trying to convert, and though many people sold their free LOOKS tokens almost immediately, others are holding onto them, trying to earn more, or even buying more.

It’s also a reminder that an open Metaverse where it’s easy to move your assets (or activity) is protection against platform complacency and monopolistic behavior. If traders can take their business elsewhere with minimal friction, service providers have to constantly be providing fresh reasons for users to stay. Which is good news for users.

Despite the entrance of a cheeky upstart looking to steal its lunch, OpenSea’s nonetheless recorded its highest monthly volume ever this month — and there’s still more than a week left of January. At the time of writing, OpenSea’s volume for January was over $4.35 billion. It also closed another round at a valuation of $13.3 billion and bought crypto wallet startup Dharma (for an estimated $100 million).

Which all suggests that, while OpenSea’s doubtless paying attention to LooksRare, it’s not yet losing much sleep over it. If LooksRare can sustain its early momentum, though, that might change.

Definitely something 🚨

Last week we announced our first open call to artists. We’re launching the MetaLetters DAO, to give our growing community the power to shape great art with a purpose.

We’re inviting artists, designers, or anyone looking to flex their creative muscles to contribute to our visual identity and help us support the next generation of web3 creators. To participate, all you need to do is create and submit a design of one (or all) of the letters of our name: M-E-T-A-V-E-R-S-A-L.

Artists can submit letters by sharing their designs to Twitter with the hashtags #WeAreMetaversal, #MetaLetters, and by tagging @HelloMetaversal. Submissions for this particular open call close on Friday, January 28. Thereafter, we’ll select a finalist for each letter, and let Twitter decide the winners. But we’re welcoming submissions long after that… because this is just the start for MetaLetters. We’ll have more details to share about that soon.

All 10 finalists from this first call will have their work printed on T-shirts to be distributed at ETHDenver, the top three will win NFTs from notable creators, and the winner will have their MetaLetter auctioned by the MetaLetters DAO.

Read all about submitting a letter to MetaLetters and more about the project over here. We can’t wait to see what you create!

Probably nothing 🤷♀️

Twitter PFPs and Insta NFTs 🖼

This week Twitter and Facebook parent Meta announced NFT plays on the same day. In Twitter’s case, it was the option for users of its $2.99 Twitter Blue service to use NFTs as their profile pictures. Those who do will have their chosen NFT displayed in a hexagon rather than a circle, and other users can click on NFT PFPs to see more information about their provenance. Especially interesting was seeing which projects got name-checked (and which didn’t) in the promo video announcing the new feature.

Not everyone was thrilled about the new feature, though, including those who argue the system is too easy to game with fakes, and others who worry letting Twitter have access to one’s MetaMask wallet and transaction history is a recipe for disaster… or increased interest from the IRS.

Meanwhile, Meta is working on options to not only let users display NFTs on Facebook and Instagram but to potentially mint them there, too. Given the company’s aggressive attempts to rebrand and reposition itself as a “Metaverse company,” the only surprising thing about this news is that it’s taken so long to make a move like this.

Nice specs, Bud 👓

Last year, beermaker Budweiser bought beer.eth for 30 ETH (~$96,000), unambiguously signaling its interest in web3. Now its more calorie-conscious sibling, Bud Light, has bought beer-faced Noun #179 for 127 ETH (~$380,000) at the suggestion of a Noun-collecting DAO which thought it might be a good fit.

Budweiser’s also dropping a collection of NFTs today called Budweiser Royalty, which “celebrates 22 emerging artists who are future Kings and Queens of the music industry” via 11,000 collectible and tradeable tokens.

Nope, we didn’t have Budweiser being an early mover in the big-brand NFT space on our bingo card either, but so it goes. This space is full of surprises.

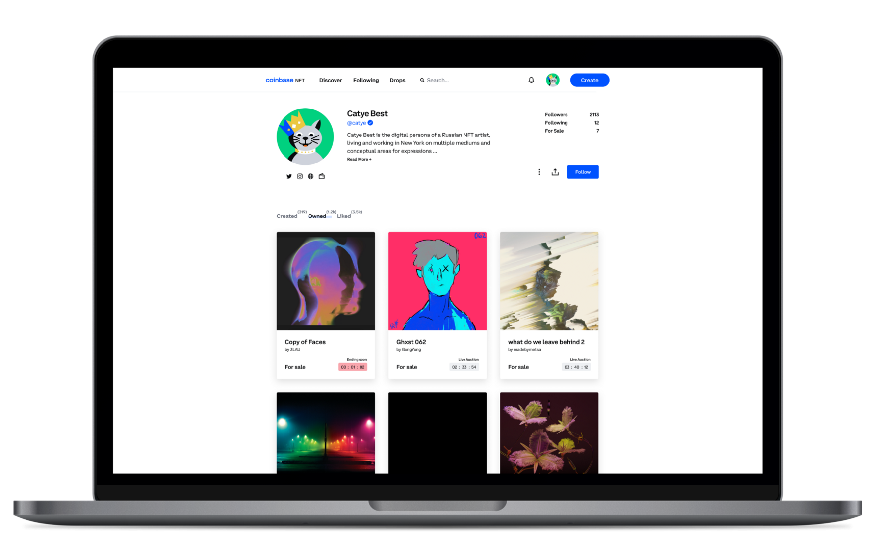

Coinbase x Mastercard 💳

Cryptocurrency exchange Coinbase wants to make buying NFTs as easy as “buying a T-shirt or coffee pods on an e-commerce site.” To this end, it’s partnered with Mastercard to make it easier for consumers to buy NFTs on Coinbase’s forthcoming NFT marketplace. Neither party goes into the specifics of quite how this will work, and Coinbase’s explanation is a little… cryptic.

[W]e’re working with Mastercard to classify NFTs as “digital goods”, allowing a broader group of consumers to purchase NFTs. And, coming soon we’ll “unlock” a new way to pay using Mastercard cards.

Whatever that means, making it easier for people to buy NFTs using fiat is a surefire way to get more players playing. Mastercard says it’s also bringing all of its “cybersecurity capabilities” to the table. Does that mean we’ll need a Mastercard-branded digital wallet if we don’t have a MetaMask one? Who knows, but hopefully we won’t have to wait too long to find out.

Microsoft’s Metaverse move ⚔️

On Tuesday, Microsoft announced its intention to buy troubled gaming company Activision Blizzard for a staggering $70 billion. That’d make it not just Microsoft’s largest-ever acquisition, but the largest ever in the gaming sector. The deal will have to get past regulators, who aren’t enamored with big tech consolidation plays, so it could take a year or more to come to fruition. Plus there’s the ongoing turmoil at Activision itself, which stands accused of fostering a toxic work environment where sexual harassment was as rampant as consequences for it were scarce.

Potential pitfalls or delays aside, this is about much more than Microsoft looking to merely shore up its Xbox division — it’s clearly a massive Metaverse-focused play. Bringing Activision into the Microsoft fold is about both business and leisure. It could enable not just Metaverse games, but also the sort of virtual meetings and hangouts Facebook parent Meta has been touting while giving Microsoft’s HoloLens mixed reality headset a much-needed raison d’être.

Flip kicks virtually 👟

In last week’s issue, we mentioned StockX was on the hunt for an NFT expert to join its ranks. Well, this week the motivation became clear. StockX is now offering NFTs tied to actual sneakers it’s keeping in actual vaults. Actual vaults which, it turns out, are very difficult to access if you decide you’d like to exchange your NFT for the actual sneakers. According to StockX:

The redemption process is not currently available, but as soon as it becomes available, any Vault NFT owner can request to withdraw their physical item from the StockX Vault. Once you have redeemed your Vault NFT, you can expect to receive the item in 45 days or less.

StockX is also promising all sorts of further developments and NFT-related offerings down the road, and is right that it’s easier to transfer an NFT between seller and buyer than it is a physical pair of sneakers. But we can’t help feeling it’s also significantly less fun.

So you wanna work in “crypto” 👔

Last year, LinkedIn saw not just an unprecedented number of crypto-related job postings, but so many they far outstripped any other tech-related postings:

Job postings with titles containing terms like “bitcoin,” “ethereum,” “blockchain” and “cryptocurrency” grew 395% in the U.S. from 2020 to 2021, outpacing the wider tech industry — which saw a 98% increase in listings during the same time period.

Speaking of which, if you’re reading this and considering a move into web3 yourself, may we direct you to the Metaversal jobs page?

🍔 Would you like fries with that? 🍟

NGMI 😵

A spicy read 🌶

There’s been an explosion of DAOs over the last year, some with noble ambitions like Constitution DAO, others with more esoteric ones. Spice DAO falls firmly into the second category. It was formed to buy a copy of a movie treatment of Dune from the 1970s which never got made. The DAO intended to buy it, scan and share its contents in some way, and turn it into an anime series… except there’s the small issue of copyright.

To add to the litany of embarrassment, it looks like Spice DAO grossly overpaid for the tome. Plus, the group’s head used their own money to buy it and may now be saddled with a gigantic tax bill. Oh, and its contents are readily available online already. Which means this whole debacle is increasingly looking like the rug-pull equivalent of an own goal. Ouch.

Dumb flex, but okay 🔒

Some collabs make perfect sense (Adidas and Prada, for instance), others make you wonder how both parties signed off on them. One such head-scratcher is the newly announced partnership between Italian luxury brand Fendi and French crypto hardware wallet maker Ledger.

It should go without saying that wearing your hardware wallet as an attention-grabbing accessory is a very bad idea. But clearly, it doesn’t, so we’re going to say it: Wearing your hardware wallet as an attention-grabbing accessory is a very bad idea. Besides, you could spend the money on ETH instead, and plump up your wallet rather than endanger it.

Hacked after all 🚨

When the first reports of Crypto.com users losing cryptocurrency from their accounts emerged, the company whose name now emblazons the L.A. arena formerly known as the Staples Center denied anything was amiss. It continued to deny it, then issued a weird statement about how no customer funds were affected, and ultimately fessed up in a not-all-that-illuminating admission on Thursday.

It turns out $34 million in a combination of ETH, BTC, and good old USD was involved, but all affected customers were reimbursed and the company has “in an abundance of caution,” gone ahead and “revamped and migrated to a completely new 2FA infrastructure.” Which we guess is reassuring. But also yet another in the near-daily reminders the news cycle brings that everyone with crypto should get a hardware wallet (just not one you wear around your neck in a tiny Fendi faux handbag, please).

To the moon 🚀

Adidas and Prada announced a new “open-metaverse and user-generated NFT project” that’ll solicit 3,000 photographs from people (1,000 of whom will need to hold Adidas’s original ‘Into the Metaverse’ token, and another 500 of whom will be people who tried, but failed to mint one) and then get artist Zach Lieberman to turn them into a jumbo collage that’ll be auctioned.

Perhaps the coolest part of the project is this, though: Not only will the 3,000 contributors retain the right to sell their creations on the secondary market once Adidas and Prada have minted them, but they’ll get a sliver of the resale of Lieberman’s combined work in perpetuity, too.

In other news, CryptoPunk owner and tennis star Serena Williams bought a Bored Ape (well, her husband, Reddit co-founder Alexis Ohanian gifted her the one she wanted), and soccer star Neymar Jr., meanwhile, now has two Apes.

In non-Ape news, Google is working on an augmented reality headset under the codename “Project Iris” and hopes to ship it in 2024, New York’s new mayor, Eric Adams, had his first paycheck converted into a combination of BTC and ETH, and Gucci and Superplastic are doing a collab of NFTs and matching ceramic sculptures.

Goats only 🐐

Whether the only NFT you own is one you got for being an AMC shareholder, or you’ve got an NBA Top Shot collection that’s got you set for retirement, you should be watching or listening to Goats and the Metaverse.

Each week, collectibles OG and entrepreneur Stan “The Goat” Meytin and Metaversal co-founder and CEO Yossi Hasson sit down with a guest to talk about digital and IRL collectibles, NFTs, and the week’s news worth knowing. This week, they’re talking to Knicks superfan, collectibles expert, and podcaster, Buster Scher. Check out the episode here:

Aside from providing invaluable insights into digital art and collectibles, Stan and Yossi are also putting together a collection of NFTs dubbed “The Goat Vault.” When the show hits 5,000 subscribers on YouTube, one of those lucky subscribers will win the contents of the vault which, at last count, was valued at just under $80,000. Let’s say that again slowly: Eighty. Thousand. U.S. Dollars!

Prefer listening? Check out Goats and the Metaverse on Apple Podcasts, Spotify, Anchor, or wherever you get your podcasts.

LFG 🥳

Metaversal x Pellas Gallery 🎨

We’re delighted to announce we’re sponsoring Boston’s first NFT exhibition, “New Horizons,” taking place at the Pellas Gallery. The show includes 10 extremely talented digital artists, all of whom are creating new work for the show. It’s also is curated by one of them, none other than NessGraphics.

The exhibition opens on February 24 and includes work by Archan Nair, Annibale Siconolfi, Gernge, GMUNK, Idil Dursun, Planttdaddii, Raf Grassetti, Raoul Marks, Ryan Talbot, and of course, NessGraphics himself. We’ll be bringing you more details about the show in the coming weeks.

Money <> mouth 💸

Each week we’ll offer you a look at an NFT project we’ve invested in and the motivation behind it. This week, it’s one of Superplastic’s CryptoJankyz. “Stank PRPL Haze #1,” to be precise.

Superplastic is the legendary maker of vinyl collectibles, art toys, and apparel. It’s also one of the first companies to seamlessly and elegantly transition from making physical products (and animations) to highly desirable and eye-catching NFTs.

It originally dropped the CryptoJankyz NFTs in July of 2021 along with a detailed backstory and roadmap, and now the company has both BAYC toys in the works and the aforementioned collaboration with Gucci, along with future drops and real-world parties. It’s already an iconic player in the NFT space and shows no sign whatsoever of slowing down.

Watchlist 👀

One of the drops we’ll be keeping an eye on in the coming days is UFO Alien Frens, the newest initiative from the Alien Frens team, a project that’s enjoyed a meteoric rise in recent months.

Alien Frens holders will automatically be whitelisted for the drop and will be able to mint one UFO each for half the price (0.1 ETH) of the public mint. There are 8,500 UFOs up for grabs, each of which can be customized via a selection of 100 traits. The Alien Frens team has also released a song, teased forthcoming mutants and merch, and is working on a game. In short, we wonder when they sleep.

IYKYK 😉

We’ll gladly wait for you to show us the lie:

Until next time, see you in the Metaverse.