Larva Labs vs. CC0 (Issue #1)

Choose your fighter.

Welcome to the first issue of The Metaversalist, a free newsletter brought to you by the team at Metaversal.

In each issue, we’ll bring you the week’s biggest NFT-related news stories, events, and drops, give you a sneak peek at opportunities we’ve spotted on the horizon, and clue you in on what we’ve been investing in or doing ourselves.

Before we go any further, we have to address the virtual elephant in the metaroom. We’re not only aware of the Bankless newsletter called Metaversal, we’re huge fans and avid readers of it. Metaversal is the name of our company, but not of our newsletter. These things happen. Nonetheless, we believe one of the benefits of the open Metaverse is that there’s not just room at the table for everyone, the table can be as big as we want it to be. So pull up a chair.

Right, let’s get straight into it!

DYOR

The biggest debate this week in NFT land was around Larva Labs’ decision to hold the IP of CryptoPunks rather than embrace a more open model like BAYC (which gives full creative rights to owners), or Nouns (which is a CC0 project). It’s a thorny issue… and like everyone, we have views.

Conventional approaches to copyright seek to provide legal protections for any creative work “fixed in a tangible medium of expression.” You can’t copyright an idea or a fact. But you can copyright a collection of pixelated punks and then defend that copyright if you so wish.

Meanwhile, a CC0 (or “No Rights Reserved”) license from Creative Commons is deliberately designed to encourage reworking:

CC0 enables scientists, educators, artists and other creators and owners of copyright- or database-protected content to waive those interests in their works and thereby place them as completely as possible in the public domain, so that others may freely build upon, enhance and reuse the works for any purposes without restriction under copyright or database law.

Prominent collector @punk4156 (who’s also the creator of the very pro-CC0 Nouns and holder of over 100 CrypToadz, another CC0 project) vocally signaled his disapproval of the fact that Larva Labs is not opening up its IP (or publicly showing it intends to do so) by dumping 35 of his CryptoPunks on the market, prompting a price drop earlier this week. As if that wasn’t enough, yesterday he sold his namesake Punk for 2.5K ETH (a little over $10 million).

We saw Punks prices fall from 150 ETH to 68 ETH in a month and, at the same time, BAYC prices continue to escalate. That’s driving speculation about when BAYC will flip Punks. But the wider ideological and cultural debate this week was about whether or not NFTs should, by default, be released under the CC0 license.

Some pundits argue collectors should be able to do whatever they like with the IP they’ve purchased and that NFT creators (particularly those making PFP projects) should consider CC0. Or that encouraging sharing creates vitality and enthusiasm for a project and gives it more clout than being restrictive.

Others see licensing decisions as project-dependent and something which should be left to the discretion of project creators.

It’s a clash that’s unlikely to be settled any time soon because the issue is so polarizing. While we understand the desire to protect IP, we’re advocates of an open Metaverse and believe that encouraging remixes and derivatives makes projects more vibrant, not less so, and drives value creation in the long run. CC0 enables network effects and can bring vitality to projects from people who aren’t even directly invested in them.

That’s one of the reasons we invested in Noun #9. All Nouns are released under a CC0 license, leaving owners to utilize them as they see fit. We see enormous value in that, and we’ve already seen how powerful that approach can be for Apes, which while not fully CC0, do allow owners a huge amount of latitude in the ways they can use their IP.

Moreover, we can’t help but feel that CC0 is better aligned with the aspirations and potential of web3. Conventional IP protections, conversely, tend to stifle creativity, incentivize patent trolls, intensify litigiousness, and are often unreasonably punitive.

We believe conventional IP law is increasingly antiquated in a world that’s trending toward openness, sharing, and accessibility. But we also appreciate the answer here might be one of both/and, rather than either/or.

But in the meantime, we’re definitely here for the grade A trolling:

Some further reading on the topic du jour:

Bankless’s thoughtful piece on NFTs and CC0.

A thorough breakdown of the LL vs. CC0 debate from The Defiant Newsletter.

Brian L. Frye’s compelling essay entitled, “After Copyright: Pwning NFTs in a Clout Economy.”

Probably nothing

Async gets generative 🎲

Programmable art platform, Async, announced yesterday that it’s getting into the generative art game. On Monday it’s launching a new generative template, and it’s roped in artists XCOPY, Coldie, and Money Alotta to launch corresponding pieces (and, you know, generate hype). Consider us hyped.

Nouning around 📈

Nouns DAO, which runs the daily auctions of PFP project (slash IP ownership experiment) Nouns, accepts proposals from its community and lets owners vote to accept or reject them. Last month it accepted proposal 22, which proposed staking 1,500 ETH (approximately $6.6 million) via Lido to earn a yield on it. This week the proposal was executed.

As of yesterday, the Nouns treasury held 14,321 ETH, which makes the investment a little less than 10 percent of its total holdings, but that’s not the interesting part. What’s important is that this move is likely to encourage other DAOs to consider similar moves to put some of their assets to income-generating use… and that it further secures the long-term sustainability of the Nouns project.

It’s a Pak thing ⃝

NFT artist Pak’s “Merge” project racked up $91.8 million in sales from 266,445 NFTs bought by more than 26,000 collectors on Nifty Gateway last weekend. Like Pak’s previous projects, this one wasn’t a straightforward sale of digital art. Instead, each NFT was assigned a “mass” value, prices for the public portion of the drop increased as time went on, and the eventual artwork that’ll be revealed to each buyer will depend on how much mass they own.

It also means that the ultimate form of the works could change depending on how much movement there is of NFTs between collectors ahead of the reveal.

And, theoretically, one whale could, umm, amass all of the mass, and create a single artwork which would then have cost $800,000 more than Jeff Koons iconic “Rabbit” which sold for $91 million at Christie’s in 2019, setting a record price for the work of a living artist.

The only gas price that really matters ⛽️

On Monday, Nifty Gateway announced that from next month, users of its marketplace will be able to buy and sell NFTs directly from their Ethereum wallets. That should mean a reduction in gas fees (the transaction costs associated with transfers or other transactions on the Ethereum network).

It’s a shrewd move from Nifty — it keeps users on its platform, rewards their loyalty, and helps smaller buyers and sellers avoid the sometimes significant cost of gas, which in turn means they have more money to spend on NFTs (yay!).

Don’t stop meme now 🏅

AMC isn’t merely a cinema chain that became one of the faces of the meme stonks movement… it’s also a company that’s embracing NFTs. It dished out 86,000 of them to people who booked for the premiere of the last Spider-Man movie, and now it’s planning to give an AMC NFT to every investor who holds its stock at the end of the year.

Whatever you think of the AMC meta-medallion, the real winner out of this might be the WAX blockchain, which has been enlisted by AMC for its drop.

NGMI

Apple hits pause on BAYC game 🎮

This week most BAYCers were expected to see their productivity tumble as they got stuck into playing the simian-faced collective’s highly anticipated “Apes vs. Mutants” game. But then Apple hit the pause button for reasons it’s yet to elucidate.

When the issue will be resolved is anyone’s guess. But we expect to see Twitter quieten down for a spell soon after it is.

Not all Punks are equal 🧐

Bloomberg reported on Monday on the pricing patterns emerging in CryptoPunks based on punks’ skin tone and other identity markers.

CryptoPunk investors say the price disparity is not a function of individual prejudice or racism, but of the fact that the people currently willing and able to pay top dollar for digital goods aren’t bidding on avatars that don’t look like them.

The solution? Easy: greater diversity in the NFT space.

Permission to dance (denied) 🕺

Singapore’s regulator has suspended crypto exchange Bitget (a name you might recognize from the shirts of the Italian soccer club Juventus). After it promoted a digital currency called Army Coin it claimed was intended to support K-Pop group BTS. The problem was the boy band has never heard of the Coin, nor does it endorse it. Awkward.

Metapoop 💩

Some stories tell you everything you need to know from the headline alone. Others have headlines you simply have to click, despite your better judgment. You can decide which category this one falls into for you:

Avatars Don’t Poop But You Can Be Sure The Metaverse Will Have Toilets.

We’re sorry. Or you’re welcome. ¯\_(ツ)_/¯

To the moon

This was an intense week for drops and announcements. Adidas unveiled its BAYC acquisition and teased a collaboration with NFT collector gmoney and NFT comic book Punks. It’s fast becoming the standard brand or celebrity play: Buy an APE → Announce your own NFT play → Hopefully profit.

Still, it’s good news for BAYC holders however you slice it.

Meanwhile, there were plenty of significant sales and purchases, too. In addition to the aforementioned $10 million+ sale of Punk 4156, we saw XCOPY’s “Right-click and Save As guy” change hands for over 1,600 ETH ($7 million), the Ross Ulbricht Genesis Collection (from the incarcerated Silk Road founder) realize almost 1,490 ETH (~$6.5 million), and BAYC topping $50 million in volume over seven days (and besting CryptoPunks’ volume over the same period in the process).

Redlion released Gazette #64 with an animation illustration of Ulbricht on its cover. LondonDAO’s “Embers” project went live. The forthcoming Coinbase NFT revealed a partnership with Fewocious, Gutter Cat Gang, and Derrick Adams. And even beermaker (and proud owner of beer.eth) Budweiser launched an NFT.

Goats only

Whether you’ve only recently created a Metamask wallet and are still trying to figure out how Uniswap works, or you’ve got a gigantic ZED stable, enough punks to full a football team, and a Pokémon card collection even Steve Aoki would envy, you should be watching or listening to Goats and the Metaverse.

Each week, collectibles OG and entrepreneur Stan “The Goat” Meytin and Metaversal co-founder and CEO Yossi Hasson sit down with a guest to talk about digital and IRL collectibles, NFTs, and the week’s news worth knowing. Check out the latest episode here:

Aside from providing invaluable insights into digital art and collectibles, Stan and Yossi are also putting together a collection of NFTs dubbed “The Goat Vault.” When the show hits 5,000 subscribers on YouTube, one of those lucky subscribers will win the contents of the vault which, at last count, was valued at over $60,000.

Prefer listening? Check out Goats and the Metaverse on Apple Podcasts, Spotify, Anchor, or wherever you get your podcasts.

LFG

Miami vibes 🌴

Like thousands of other NFT enthusiasts, we were in Florida last week for Miami Art Week (and Art Basel and the other adjacent events). While there, we hosted BitchCoin Salon with our first artist-in-residence, Sarah Meyohas, whose BitchCoin project of selling fractionalized portions of her work via an on-chain currency was a proto-NFT project.

We also managed to get stuck on a yacht with Diplo, met a slew of institutional art investors buying their first NFT pieces (probably nothing), and didn’t get to hit either the beach or the gym… the universal indicators of a busy event.

Money <> mouth 💸

Each week we’ll offer you a look at an NFT project we’ve invested in and the motivation behind it. We’ve already outlined above why we’re so bullish about our first acquisition from Nouns, so this week we’re going to talk about another of our iconic assets: A RarePepe “Nakamoto Card.”

Originally released in September 2016 (which makes it a pre-Punk project), there are only 300 in existence. We believe that as the Metaverse matures, assets like this will not only become more valuable financially but culturally. Early NFTs aren’t just collector grails, they’re an essential part of the sector’s history and we see enormous value in preserving them.

Watchlist 👀

The upcoming event we’re most excited about this week isn’t a drop but a reveal. We’re very enthusiastic about RTFKT Studio’s CloneX avatar collaboration with legendary artist Takashi Murakami. We’ve invested in a number of vials and are eagerly anticipating this weekend’s reveal (and hoping for a rare Clone, obvs).

Beyond the potency of the collaboration or the quality of the art, the reason we’re invested in this project is the long-term potential of the ecosystem RTFKT’s building. This is no fad.

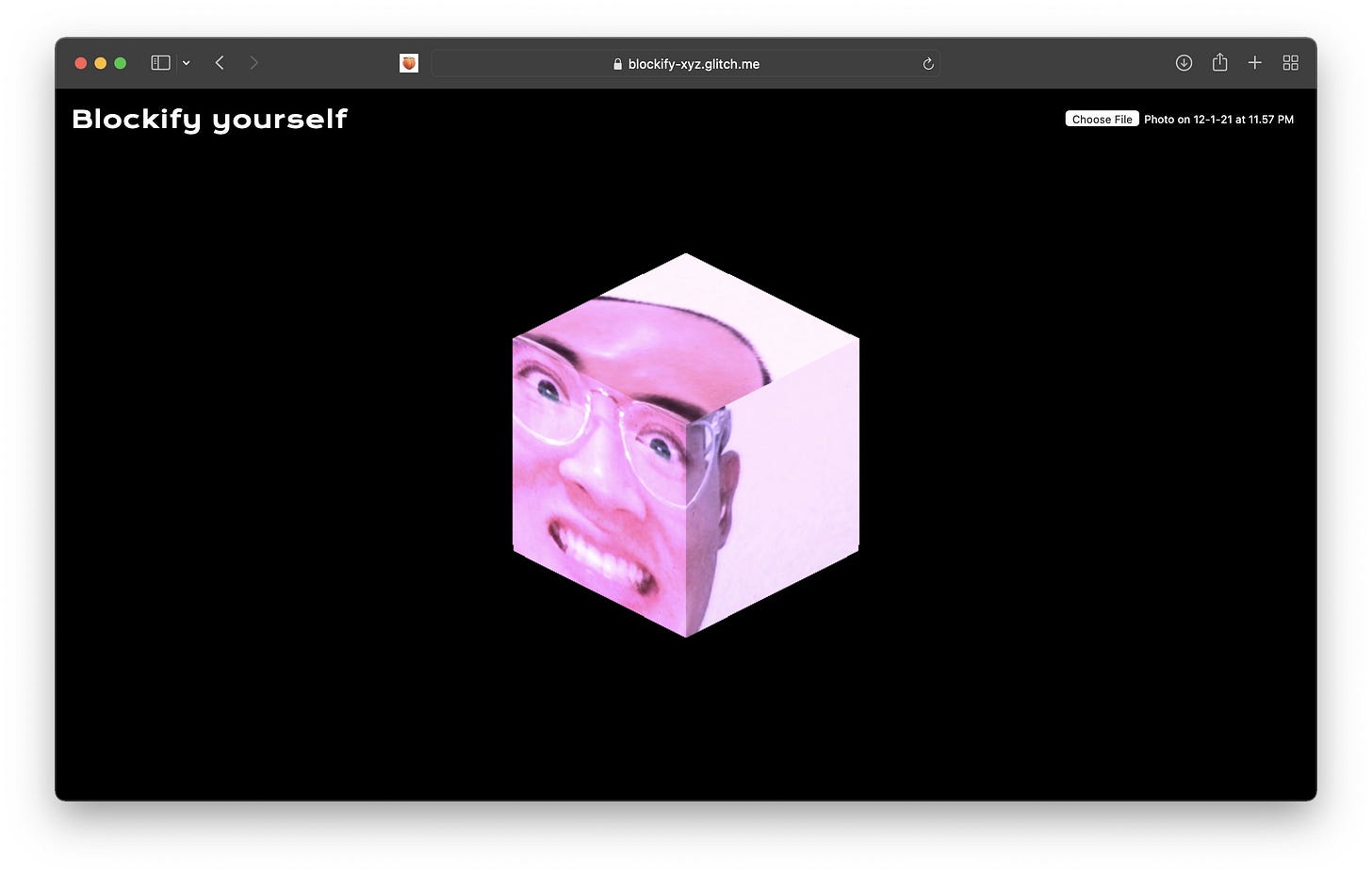

IYKYK

Twitter user @tarngerine made a block.xyz leadership photo creator tool so you, too, can look like one of the exec team at the service formerly known as Square but now called Block and the primary focus of twice-former-Twitter-CEO, full-time beardy man, and avid crypto fan, Jack Dorsey. And the results are, well, no weirder or less unsettling than the inspiration.

The same developer has a plug-in on Github called “web3-to-butt” that changes any instance of “web3” you encounter online to, well, “my butt.” Do with that knowledge what you will.

Until next time, see you in the Metaverse.