Gas wars, Something tokens, and the horrors of the hidden folder (Issue #21)

Maybe there's no such thing as a perfect NFT drop.

Inflation and interest rates are up, the price of Ether and NFT trading volumes are down but, nonetheless, new NFT projects continue to launch, new use cases continue to be found, the loud, whooshing sound of venture capital racing into the space continues unabated, and reports of the death of NFTs continue to look greatly exagerated to anyone on the inside looking out.

Right, let’s get straight into it!

DYOR 🧐

The Otherside drop from Bored Ape Yacht Club’s creators, Yuga Labs, didn’t go off as seamlessly as fans had hoped it would. On offer were 55,000 parcels of virtual land in Yuga’s still-only-vaguely defined metaverse. But various snafus led to disappointment for some, rage for others, and millions of dollars in failed transactions for many. This despite Yuga being a multi-billion-dollar enterprise with the means to employ the finest minds in the space.

Despite the perceived problems with the drop, the company realized $860 million in sales in less than 48 hours, and the secondary market volume in the first 24 hours alone was record-setting. Hiccups or not, whatever Yuga touches people continue to want a piece of. And they remain willing to pay handsomely for a chance to buy into the most valuable (and recognizable) brand in the fledgling NFT universe.

The primary criticism leveled at Yuga stemmed from its decision not to stagger minting, choosing instead to let everyone mint simultaneously, pushing gas prices to around 3 ETH (~$9,000) almost immediately. Yuga came in for further criticism because it later tweeted a response to those angry about the gas wars where it blamed the Ethereum network, and suggested it might have to investigate alternative blockchains for future drops.

Now, Ethereum certainly isn’t suited to high-demand drops like this, that’s not news, but as some commentators pointed out, the smart contracts for the drop could’ve been written more efficiently, and minting could have been timed to prevent the rushes we saw. Especially given Yuga can afford to hire the best in the game. Nonetheless, as expected, the project minted out anyway. And Yuga is refunding the gas fees of those people whose transactions failed.

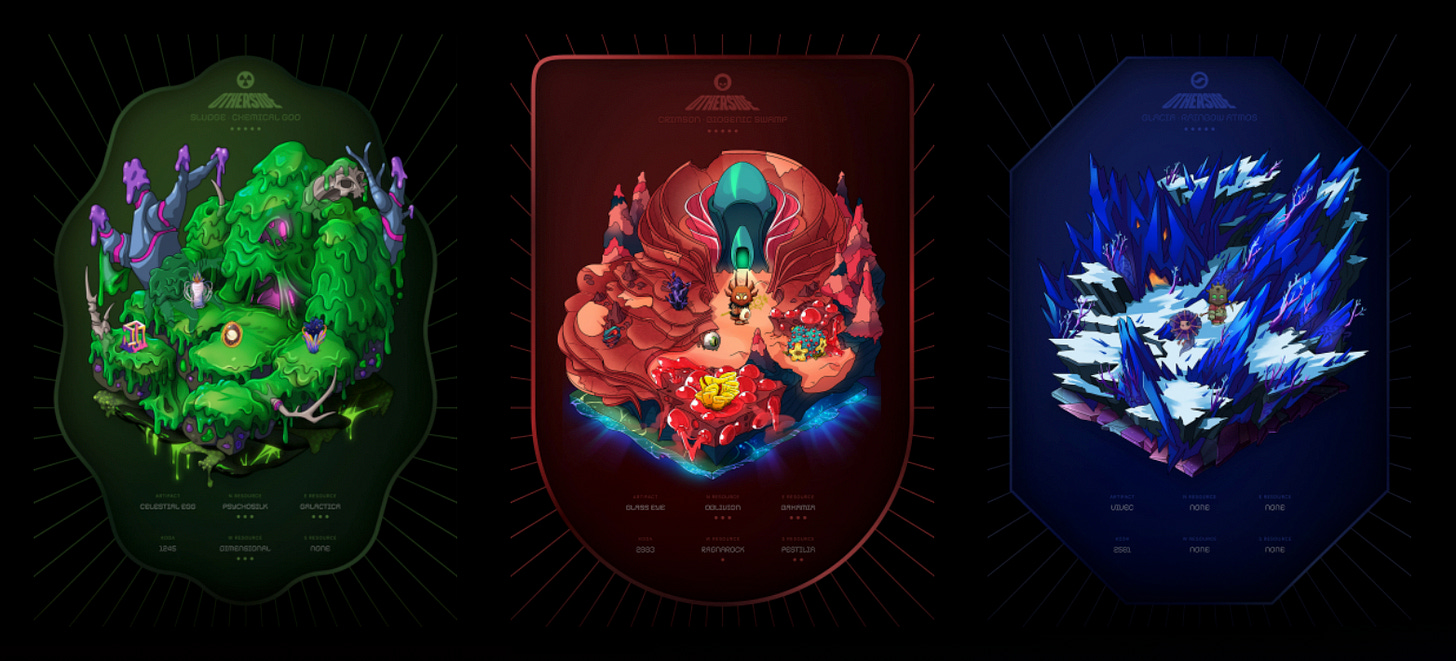

So, what did successful minters actually get? Well, the virtual land on offer was divvied-up into three main categories (and five tiers). The most valuable and sought-after is the Biogenic Swamp, which is centrally located in the Otherside. There are 10,000 plots in the Biogenic Swamp, representing 10% of the total land supply, and they were earmarked for BAYC holders.

Next up, there’s the Chemical Goo (outskirts, 20%/20,000, allocated to Mutant Ape holders), and then the third tier comprised of the Rainbow Atmos, Cosmic Dream, and Infinite Expanse. Tier three land parcels are the most prolific, and 15%/15,000 of them were allocated to developers, Yuga itself, and its partners. The remaining 55%/55,000 could be purchased with ApeCoin… but only by people who had heeded the mysterious call to complete KYC forms that Yuga put out in early March (and for which it also received plenty of hate).

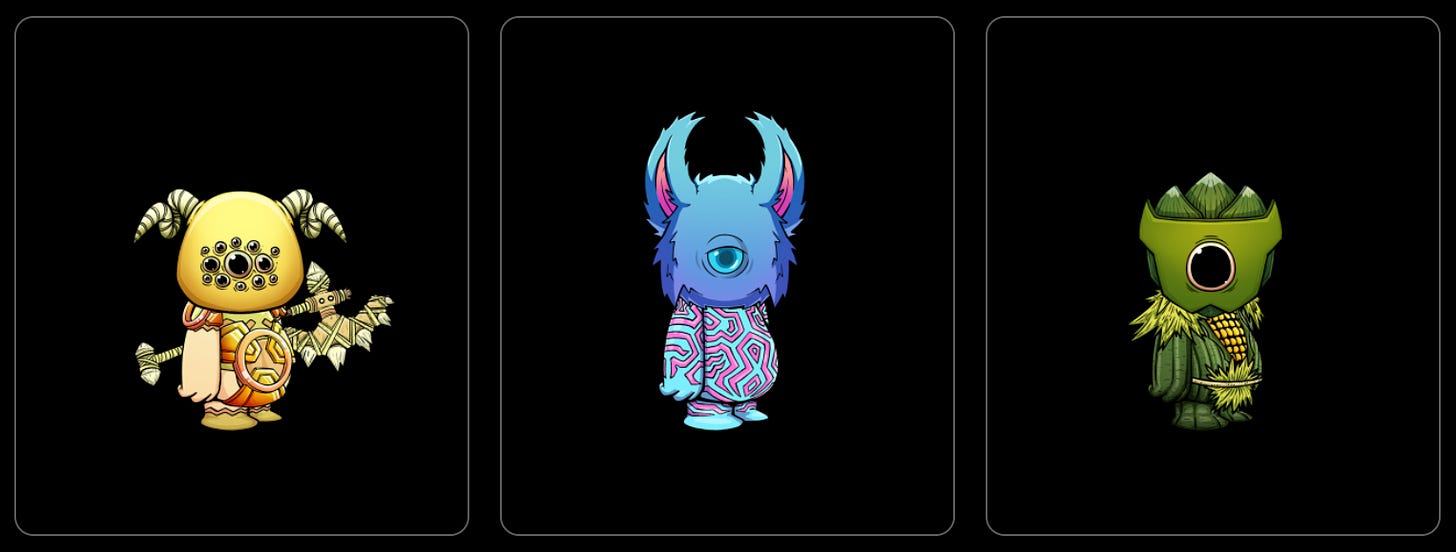

Even more exciting than the land, though, was the chance to get a Koda, the new 10,000-piece profile picture project from Yuga. The fortunate 10% of minters who did get a Koda with their land could have flipped it days later for anything between 25 and 55 ETH ($90,000-$165,000), depending on which region of the Otherside the land to which the Koda was tied was located in.

Will those who paid outsized gas fees or whose transactions failed entirely forgive Yuga Labs for its decisions? Frankly, it doesn’t matter. Though the company has definitely lost some loyal fans, it nonetheless remains the biggest name in the NFT space with enviable profit margins and a gargantuan war chest. It has the funds to do whatever it wants, and the Otherside dropped showed that there is an insatiable appetite for Yuga’s wares.

It’s going to take more than a less-than-optimal drop to rattle Yuga loyalists or endanger its position. But it’s also a reminder of how early it still is. Yuga is little over a year old. And despite its bulging coffers and access to the most talented developers and engineers, it’s still — like the rest of us — feeling its way around the barely illuminated world of NFTs.

🤲 Be grateful for what you have 🙏

Sounds rare 🎧

Art of the Matter 📢

On Monday, our weekly Twitter Spaces series will see hosts Jessica Angel and Craig Wilson joined by Snowcash founder Georg Bak for a conversation with the “President of Free Republic of Liberland” Vit Jedlicka, and Nat Geo photographer and founder of art-for-social-change platform Amplifier, Aaron Huey.

Head over to the tweet below to set a reminder, or set one of your own on the calendar or mobile device of you’re choosing, and tune in at 12 p.m. ET / 6 p.m. CET. Or don’t, whatever, we’re not your real dad. But we’re so convinced you’ll learn something if you tune in, that if you don’t, we’ll refund you the price of admission. Oh, it’s free? Well, all the more reason to tune in. This sort of access usually costs a pretty penny.

Probably nothing 🤔

A little Something something 🎟

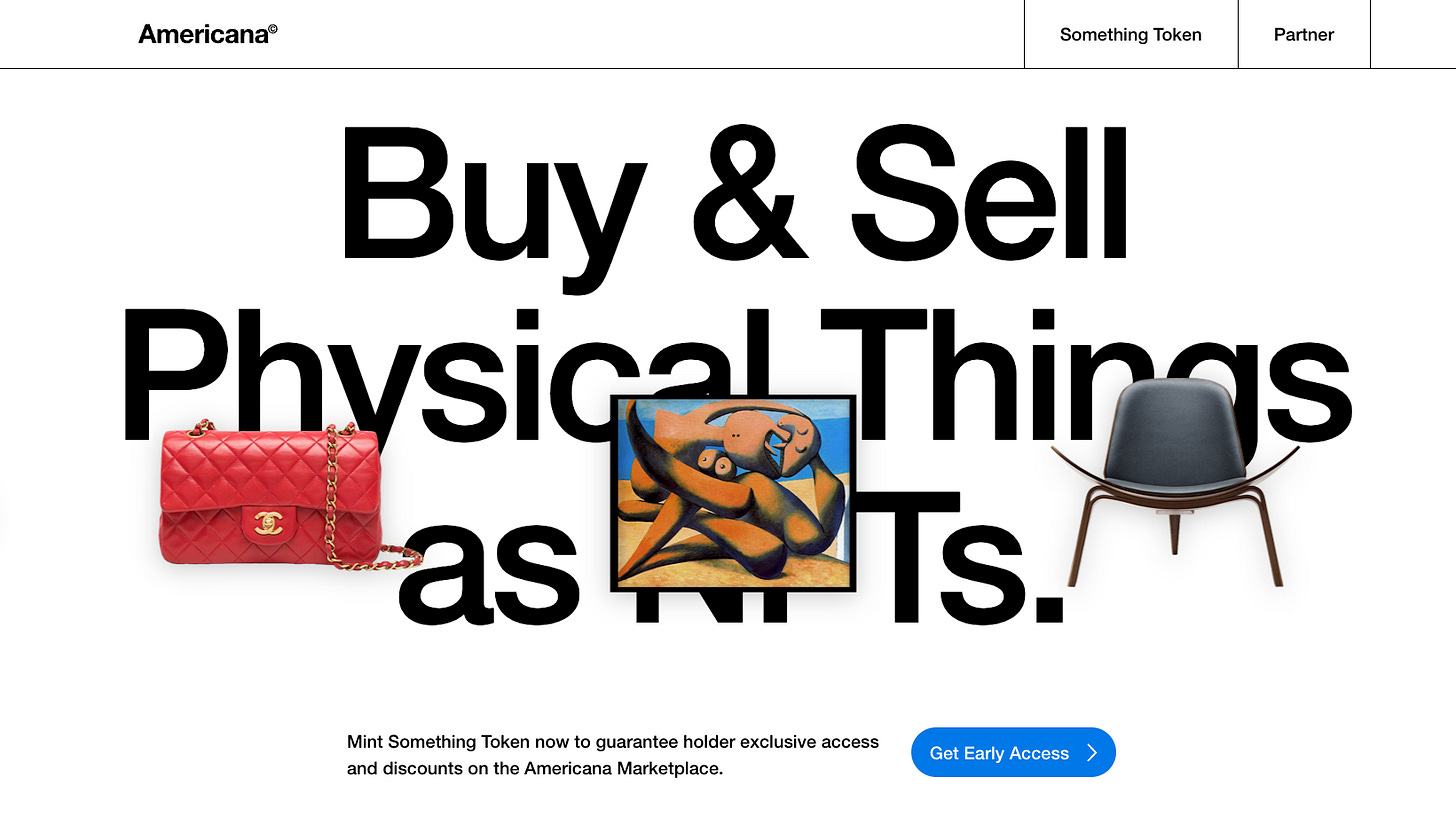

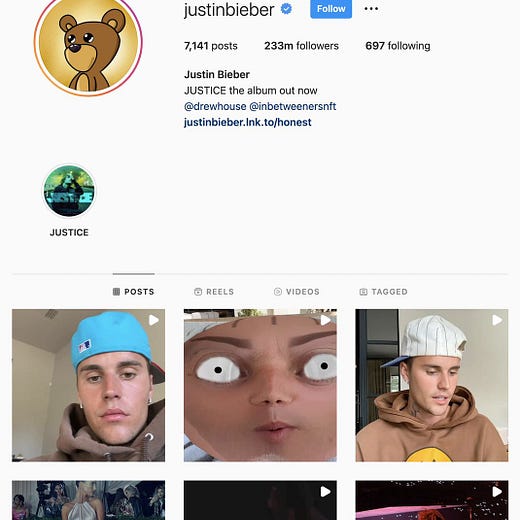

The Something Token is one of a number of new projects from Americana, a company that counts among its founding team, Reddit co-founder, Punk-and-Ape-holder, and all round nice guy, Alexis Ohanian (better known to tennis fans as Mr Serena Williams).

The forthcoming Americana Marketplace is a platform for selling physical things as NFTs. Think cars, handbags, sneakers, jewelry, or other commodities. If you think about the way money made it easier to transact and move value without having the underlying goods (for a time, gold) on hand, the idea doesn’t sound that outlandish.

By buying one of the 10,000 tokens (which minted at 0.069 ETH and is now trading around 0.26 ETH) you get access to the an as-yet-unconfirmed discount for using the platform. In addition to the Something Token, Americana also launched the ProbablyNothing token, which is trading at around 11 ETH. There are only 100 of them, and they grant holders discounts in perpetuity for trading on the marketplace.

MetaLetters Meets 🔠

MetaLetters is launching a community initiative called MetaLetters Meets on Tuesday, May 10 at 12pm ET. These are virtual sessions live streamed to Twitter, LinkedIn, and YouTube, where MetaLetters artists meet with our team for a friendly, and public conversation.

The purpose of MetaLetters Meets sessions are to update our community on the current status of the MetaLetters project, jointly collaborate on shaping its roadmap, give artists a platform to share their work with the community, and engage with artists to inform the structure of the MetaLettersDAO in such a way that it responds to their practices and intended directions.

Bag boosters 💰

The week that was (April 30 - May 6, 2022) 🗓

Yuga Labs dominates the top three spots of this week’s chart, followed by newcomer PXN: Ghost Division, and Beanz, the Azuki airdrop that revealed this week.

Interestingly, Moonbirds drops out of the top 10 to number 11 this week, despite being the talk of the town only a fortnight ago. It’s still trading at nearly 30 ETH, though, so don’t feel too bad for it or its holders… and expect to see it back on this chart soon enough.

🎓 Some lessons are harder than others 💸

To the moon 🌜

Coffee chain Starbucks announced its intention to release NFTs later this year that it says will offer access to “a host of unique experiences and benefits, worthy of a genesis NFT collection,” using an “environmentally sustainable” web3 platform. What does that mean? We don’t know, but it’s another sign the line between the mainstream and the NFT market is getting blurrier by the day.

Coinbase NFT opened its doors to the public this week, so now anyone can trade using the platform, which we have to admit does have a remarkable resemblance to an image-based social network owned by another aspirant master of the metaverse, Mark Zuckerberg.

Artist Takashi Murakami launched his long-awaited Murakami.Flowers collection of pixelated flora.

And Doodles hired a suit, Julian Holguin the former president of Billboard, to be its CEO.

🪡 Thread of the week 🧵

Goats only 🐐

Whether you own the equivalent of a continent in the Otherside, or the only “Otherside” you know is the Red Hot Chili Peppers’ song, you should be watching or listening to Goats and the Metaverse.

In each episode, collectibles OG and entrepreneur Stan “The Goat” Meytin and Metaversal co-founder and CEO Yossi Hasson talk about digital and IRL collectibles, NFTs, and the week’s news worth knowing.

This week, they unpacked the wins and woes of the Otherside drop, offered their take on the recent Ethereum Name Service boom, explained the Something Token (while celebrating Stan’s birthday), and talked about some potential buying options now that the price of ETH is low. Check out the latest episode here:

Aside from providing invaluable insights into digital art and collectibles, Stan and Yossi are also putting together a collection of NFTs dubbed “The Goat Vault.” When the show hits 5,000 subscribers on YouTube, one of those lucky subscribers will win the contents of the vault which, at last count, was valued at nearly $50,000.

Prefer listening? Check out Goats and the Metaverse on Apple Podcasts, Spotify, Anchor, or wherever you get your podcasts.

LFG 🎉

Money <> mouth 💸

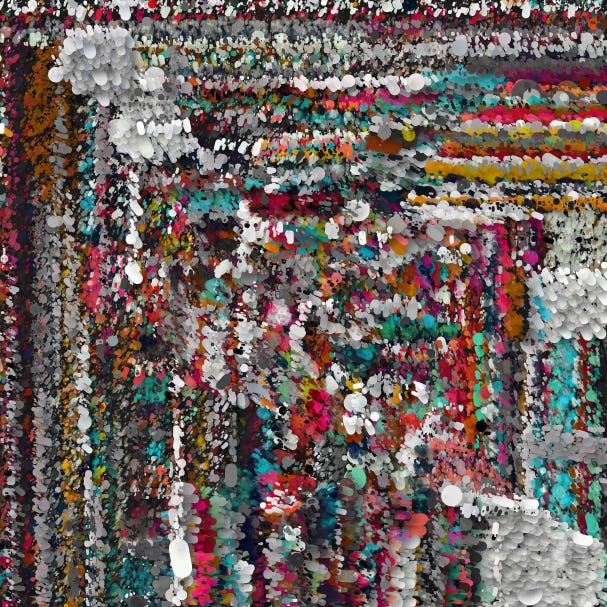

Each week we’ll offer you a look at an NFT project we’ve invested in and the motivation behind it. This week we’re looking at “De/FragV3 #286” by Karsten Schmidt (AKA @toxi).

Schmidt is a “multidisciplinary software engineer, computational designer, artist, researcher, teacher, prolific open source tool maker” who’s been coding for more than 25 years. He’s such an OG that when he started out being an OG — whether in digital art or hip-hop — wasn’t even a thing. Moreover, we love how creative, boundary-pushing, and visually arresting and enchanting his work is.

IYKYK 😉

Until next time, see you in the Metaverse.